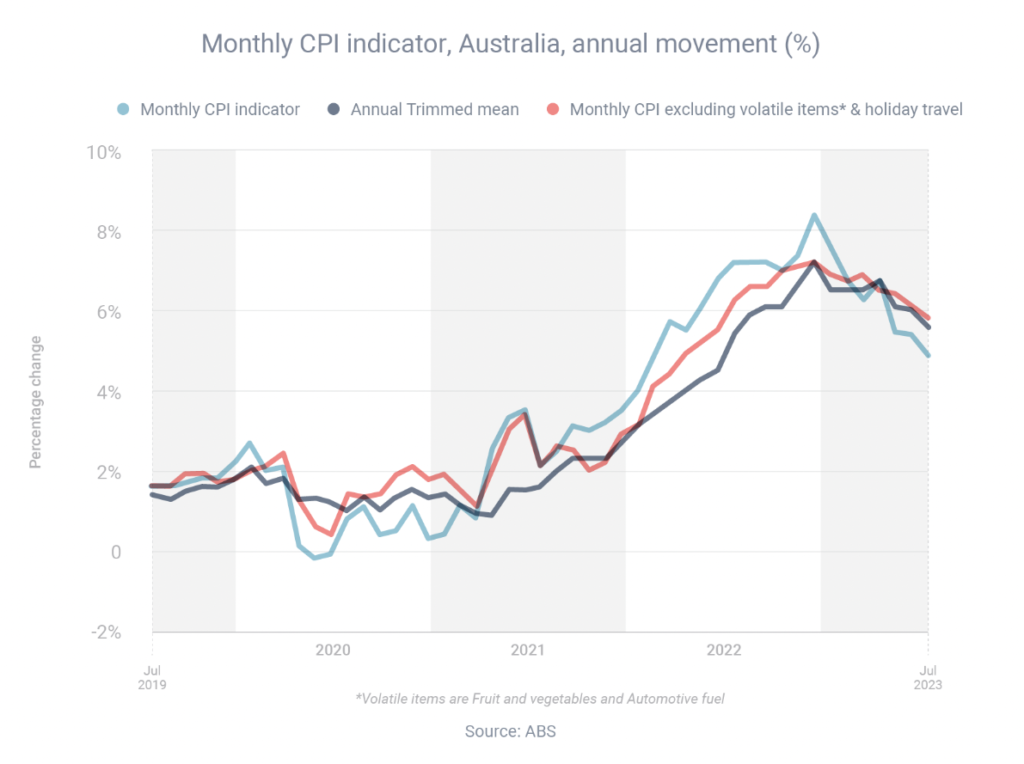

Inflation has fallen for three consecutive months, strengthening the case for those who believe interest rates are at or near their peak.

After inflation rose to 6.7% in April, it fell to 5.5% in May, 5.4% in June and 4.9% in July, according to the Australian Bureau of Statistics.

Three of the big four banks believe the Reserve Bank will no longer raise the cash rate (currently 4.10%), while the fourth believes there’s only one more hike to come. Inflation will be key to the Reserve Bank’s decision, because the main point of the rate rises that began in May 2022 has been to reduce inflation to the target range of 2-3%.

Inflation has fallen for three consecutive months, strengthening the case for those who believe interest rates are at or near their peak.

After inflation rose to 6.7% in April, it fell to 5.5% in May, 5.4% in June and 4.9% in July, according to the Australian Bureau of Statistics.

Three of the big four banks believe the Reserve Bank will no longer raise the cash rate (currently 4.10%), while the fourth believes there’s only one more hike to come. Inflation will be key to the Reserve Bank’s decision, because the main point of the rate rises that began in May 2022 has been to reduce inflation to the target range of 2-3%.

Learn more financial strategies today. Schedule an obligation-free call with us.

Leave A Comment