STEP 1: We start by having a conversation. Get an understand what it is you want to achieve. We also check what your situation is:

- Are you looking to buy or refinance or planning to purchase an investment?

- We look at your family situation, your income, currents debts (personal loans, car loans, credit cards, …) and other commitments.

- Are you single or married? Do you have dependents?

With that information we look at your options, what can we do for you.

STEP 2: If we believe we can help, we start document collection. We set up a client portal for you and list the documents that need to be uploaded.

After this we create two of the four compliance documents:

- The Privacy form

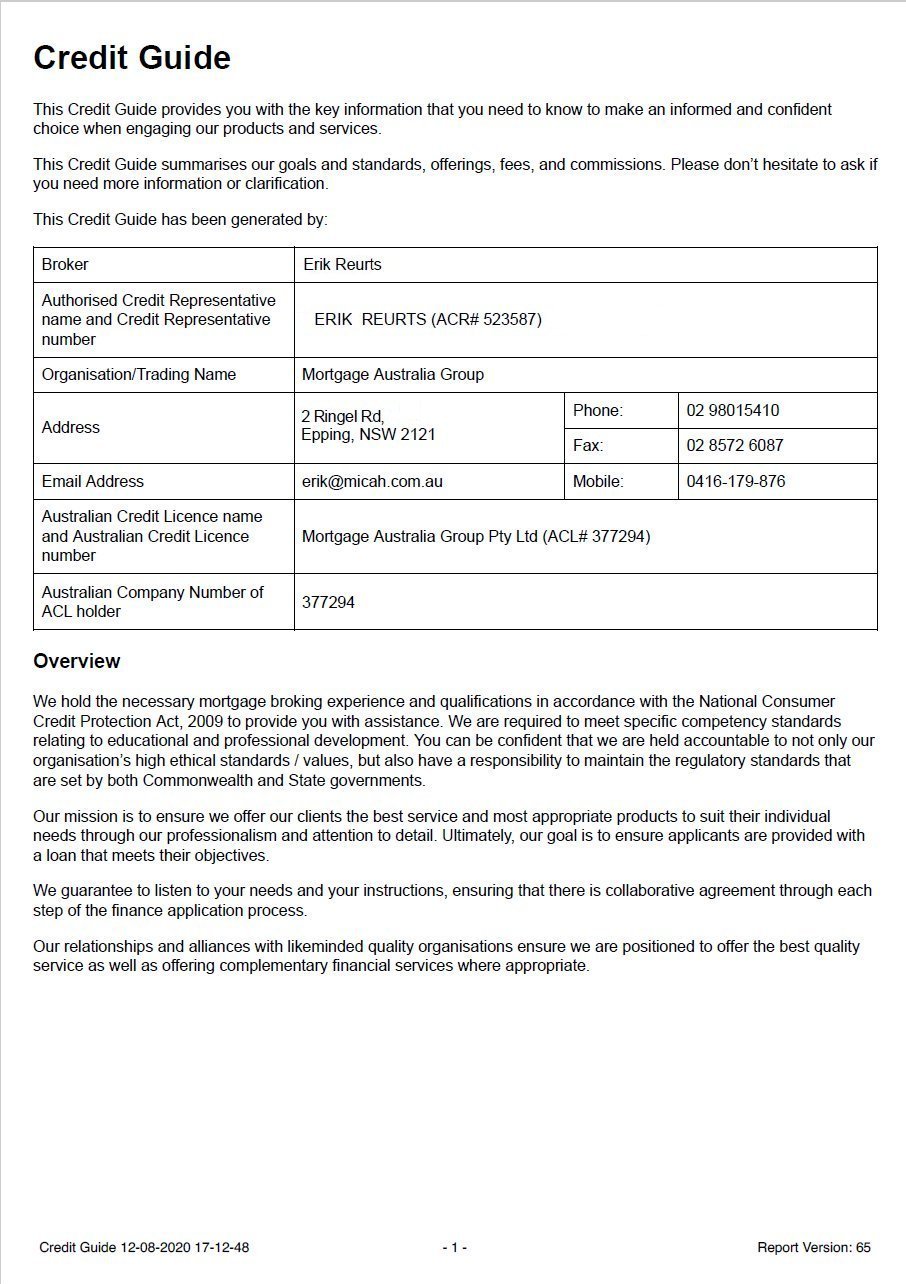

- The Credit Guide

They need to be signed and returned.

The documents required for the application can be grouped into three main categories:

- ID documentation (drivers licence, passport, …)

- Income documentation (pay slips, tax return, group certificate, …)

- Debt statements (mortgage statement, credit card, car loan, afterpay, …)

STEP 3: Once we have received all the information and documentation, we do our checks.

Credit check, affordability calculation, lender policy and guidelines check. So that we can find a solution that is right for you.

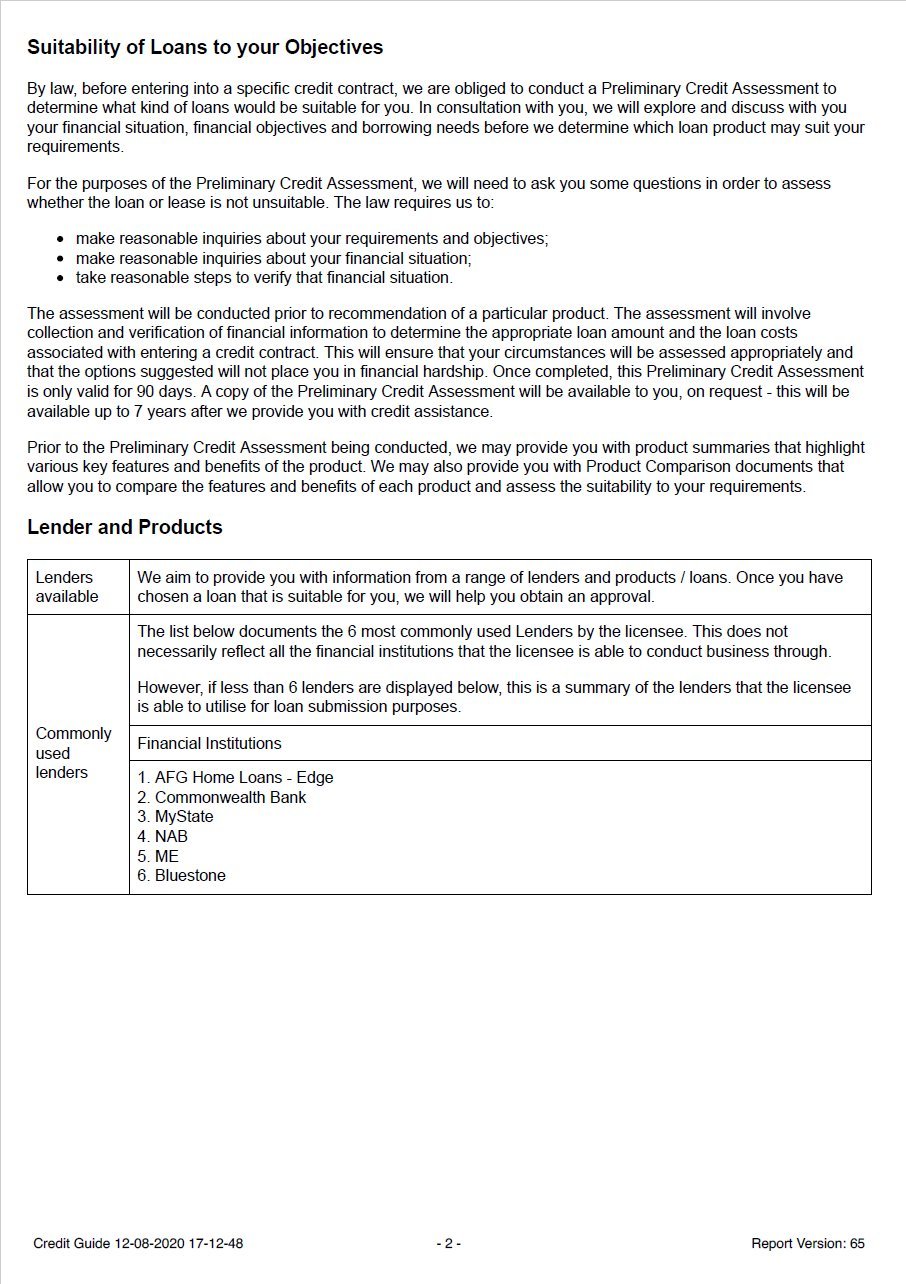

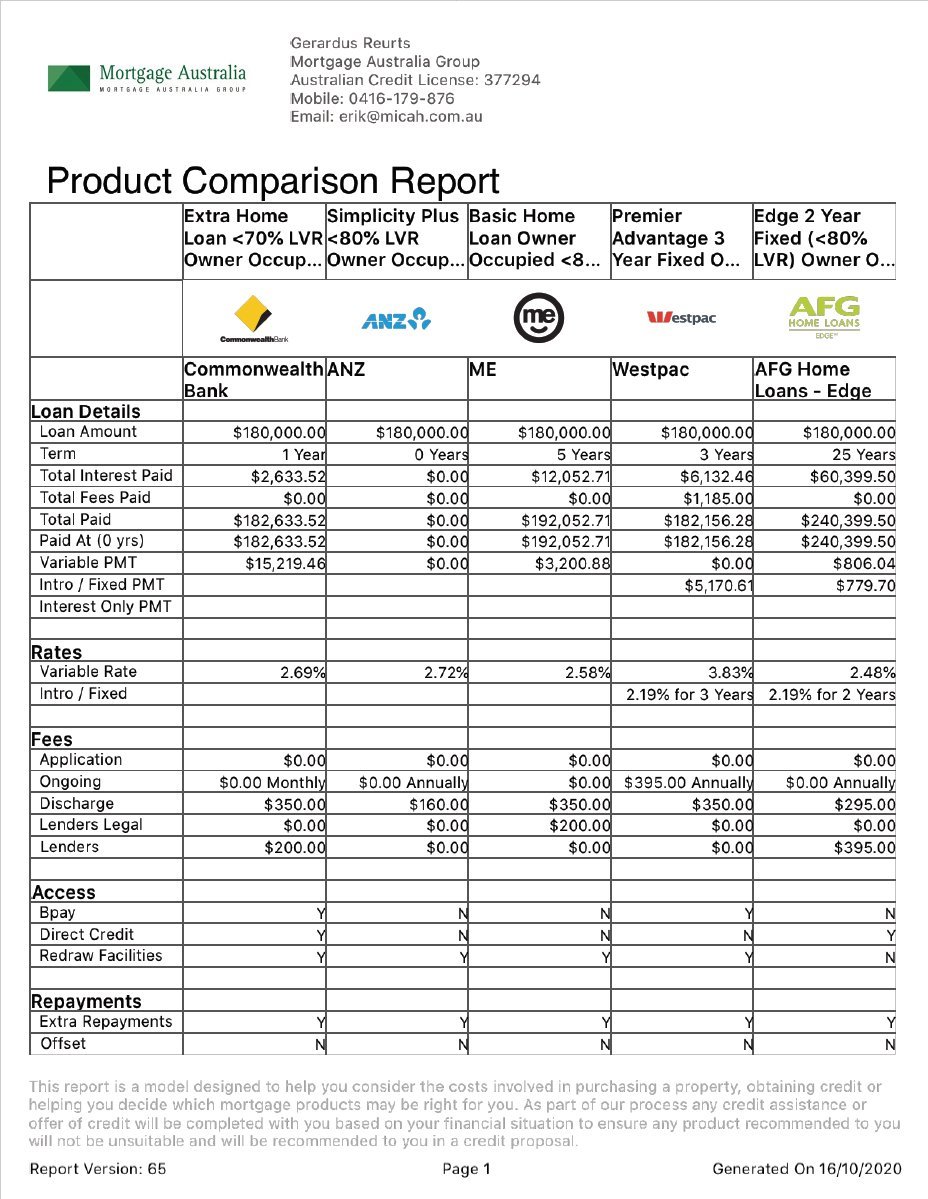

Here we present to you a selection of lenders and products that will work for you (The comparison report), that will help you achieve your goals.

Your preferences play a big part in this as well and we ask for your input. We set up a call to talk through the options, answer any questions and decide on a lender and product.

STEP 4: Nearly there! We now get into the application stage.

Here we finalize the last two compliance documents:

- Fact find

- Proposal

And the lender documents.

We then create a detailed story to outline your plans so the lender understand who you are, what your situation is and what your plan. Now we are ready to submit your application.

The application is placed in the lenders assessment queue.

The Comparison Report

The Privacy Form

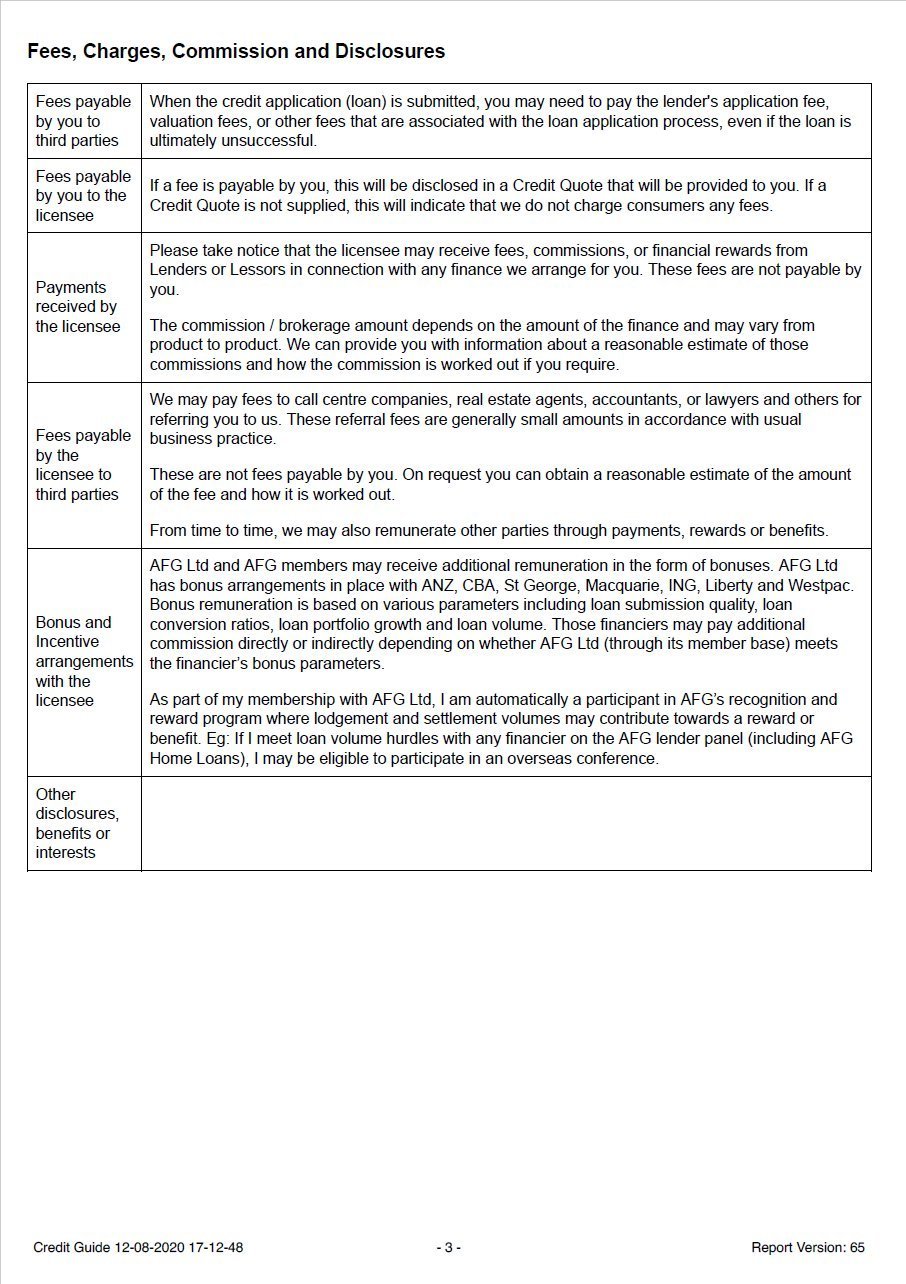

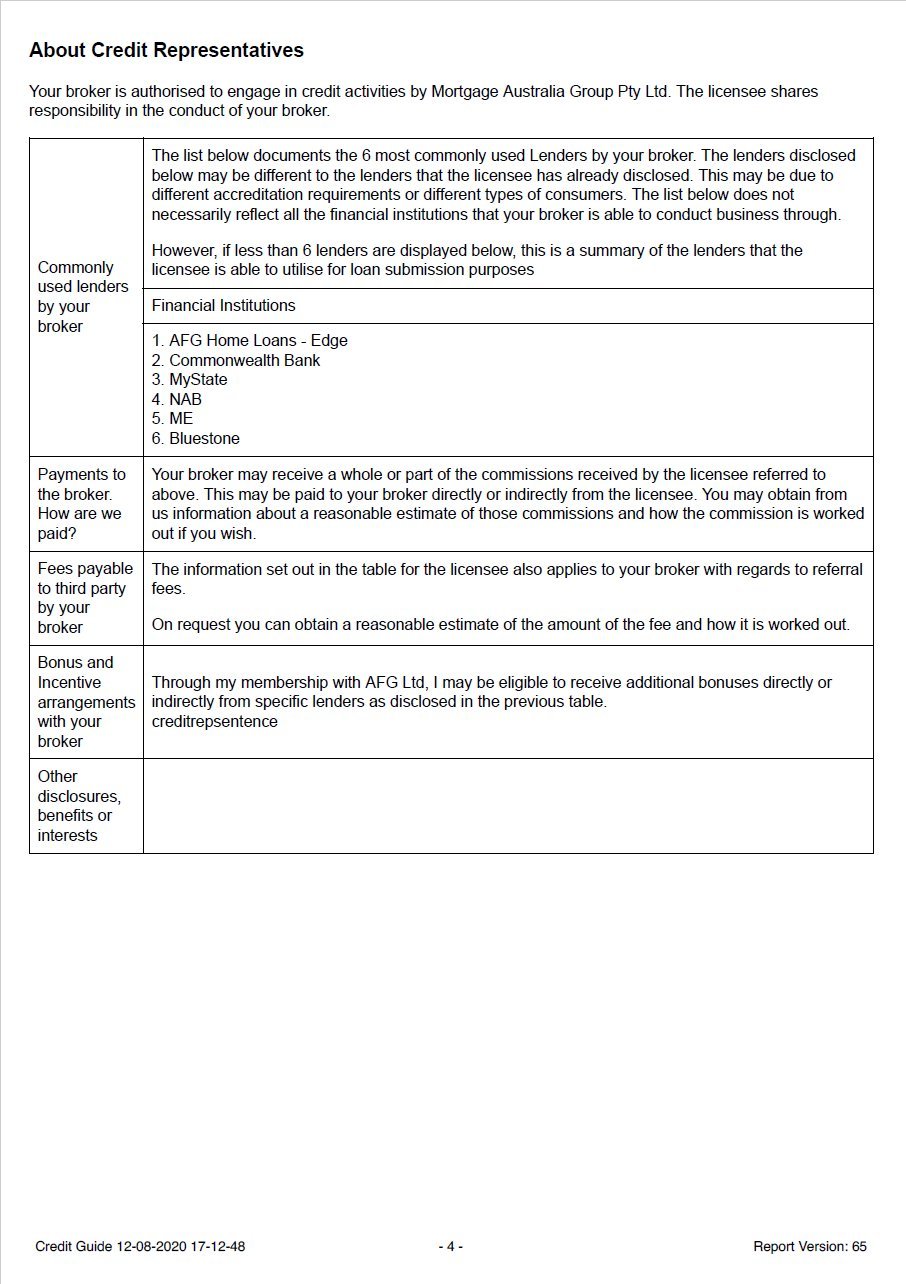

The Credit Guide