Save money on your mortgage every month.

And the best part is in many cases this can be done without the usual headaches:

- NO application or refinance fees

NO need for payslips or ID check

NO credit card statements

NO time consuming application

NO waiting weeks to see if you qualify (and then more weeks to settle)

NO changing your everyday banking

Since Nov 2022

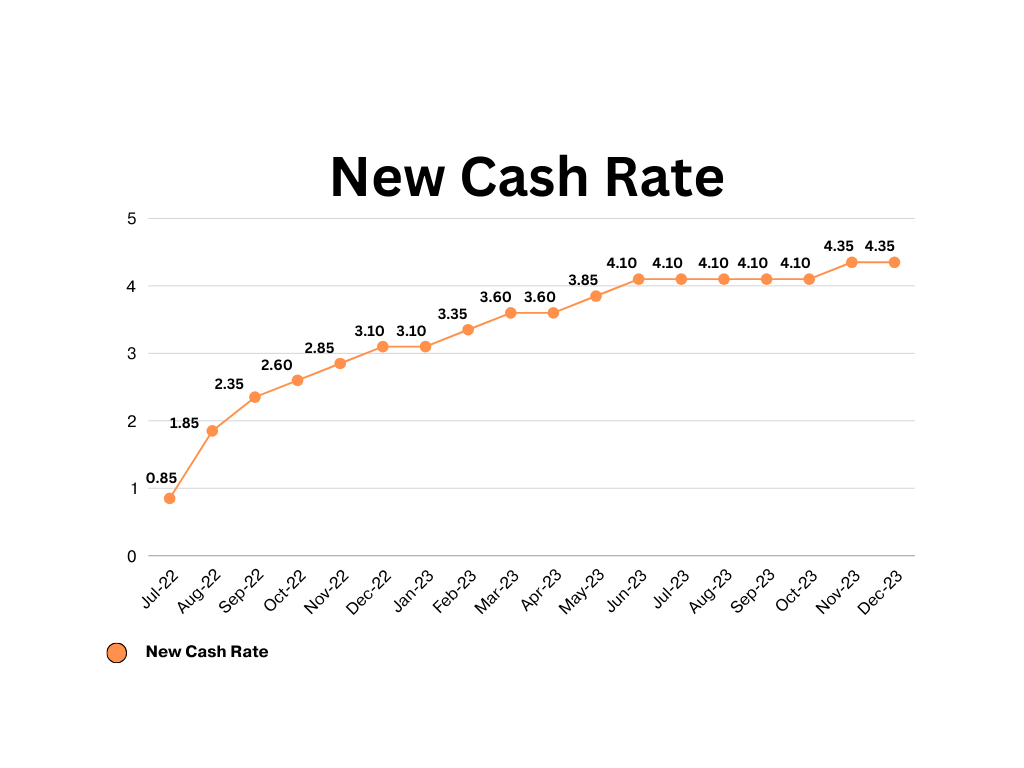

Rate increases since Apr 2022

There have been 8 rate rises by the RBA in 2022, see the table below. The impact this has on you depends on your specific loan balance. The second table shows repayments based on loan amount and interest rate.

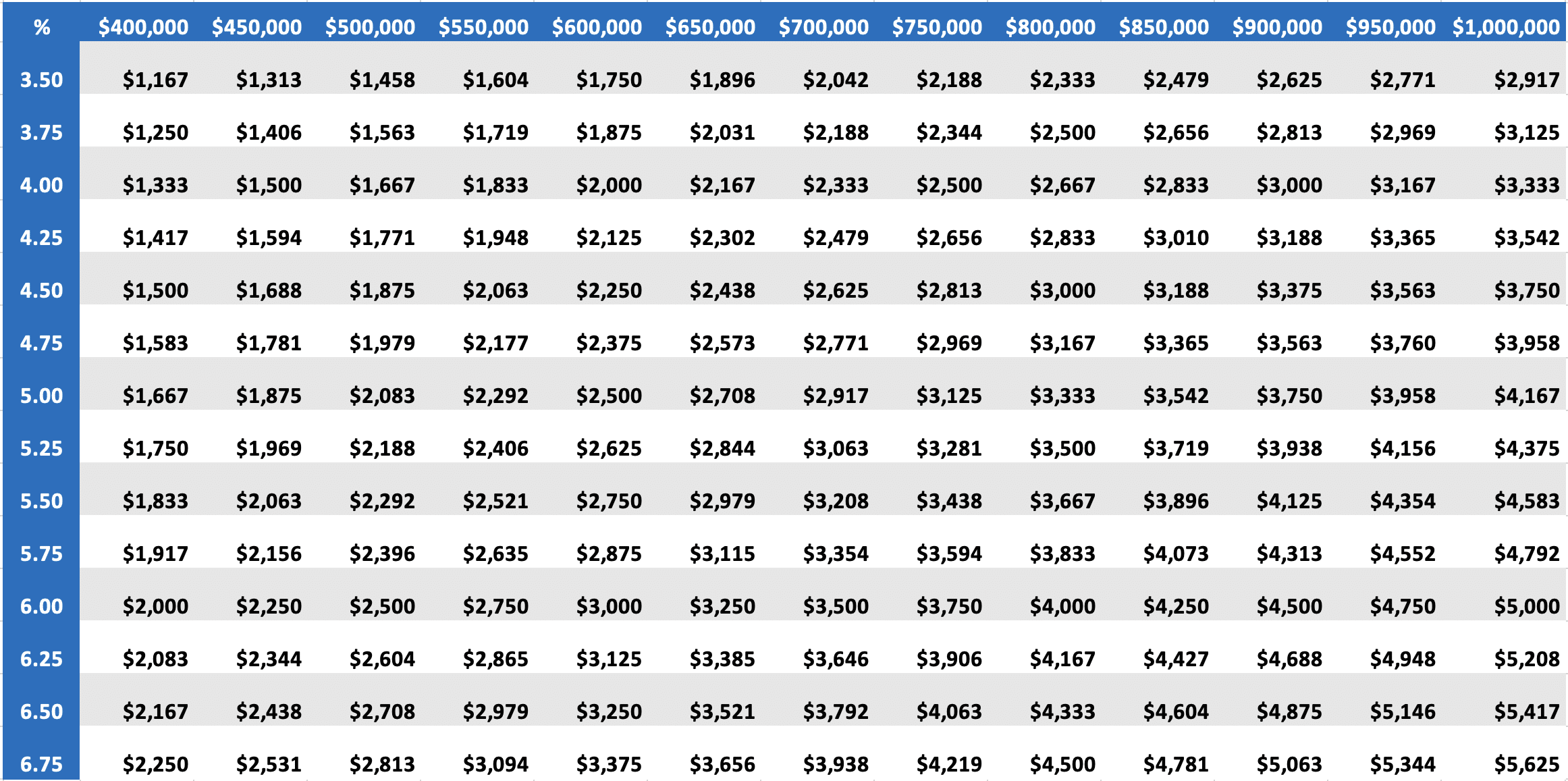

Compare the repayment on your current interest rate vs. a 0.25% or 0.50% lower rate. That is your possible savings.

Potential Savings

The below table is for principal and interest repayments on a 25 year loan term. Compare what difference a 0.25% or 0.50% rate reduction can make on your monthly mortgage repayments.

WARNING! Banks increase rates for existing customers over and above what they charge new customers (First noted by the RBA in 2020, statistics show a higher average interest rate for existing loans vs. new loans). And that gap widens for customer who have been with their lender 2+ years & 5+ years),

WARNING! Banks increase rates for existing customers over and above what they charge new customers (First noted by the RBA in 2020, statistics show a higher average interest rate for existing loans vs. new loans). And that gap widens for customer who have been with their lender 2+ years & 5+ years),

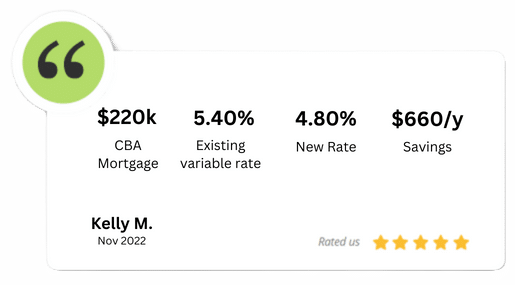

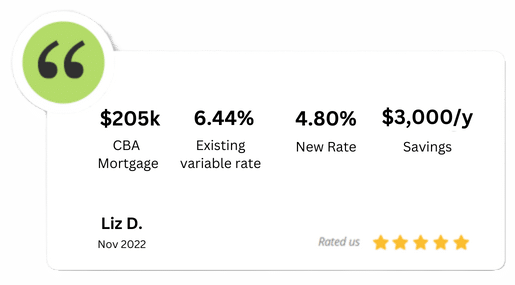

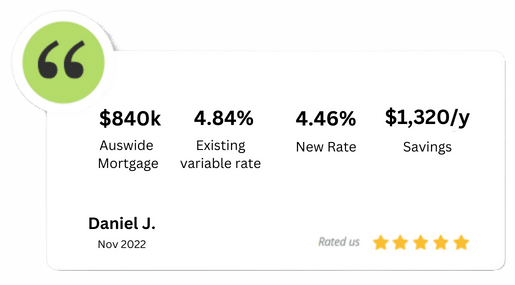

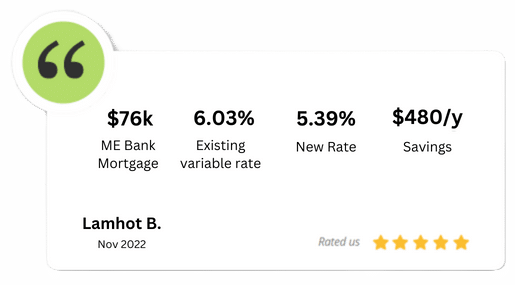

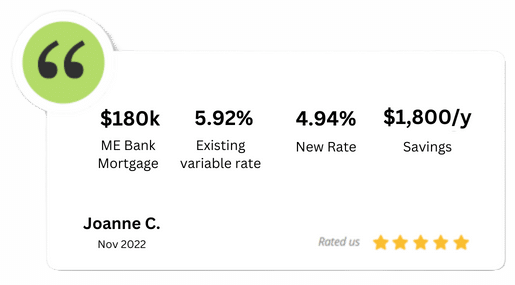

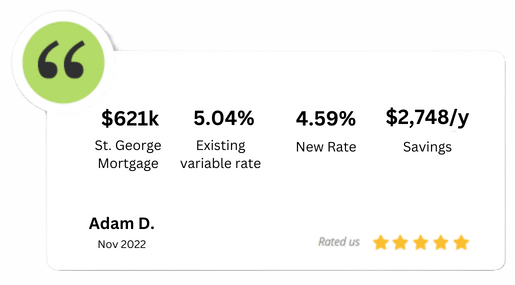

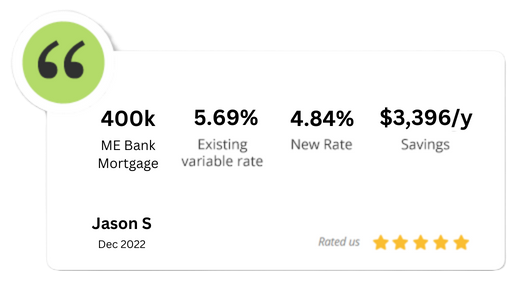

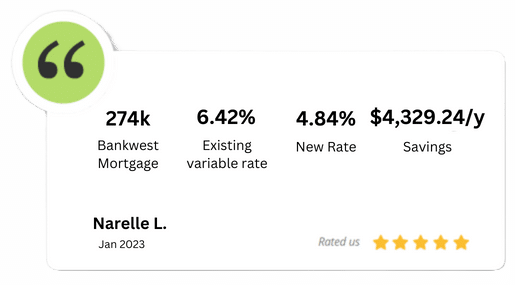

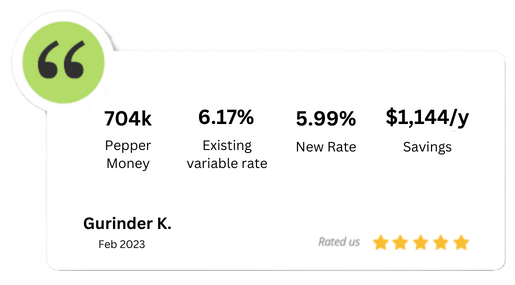

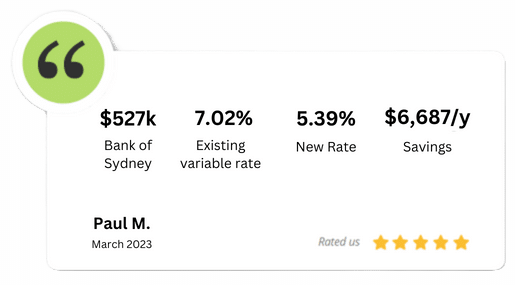

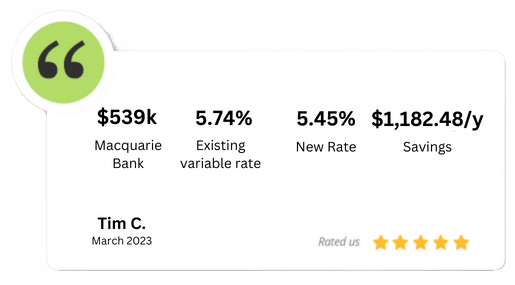

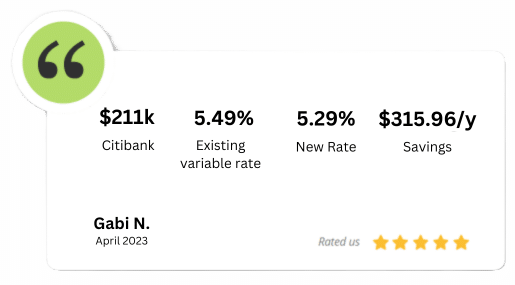

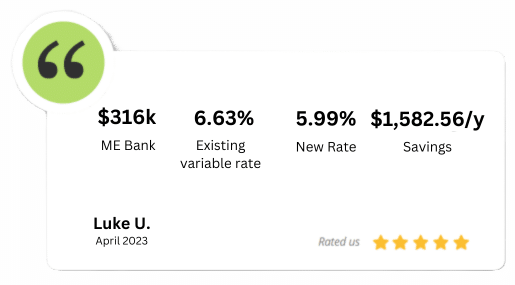

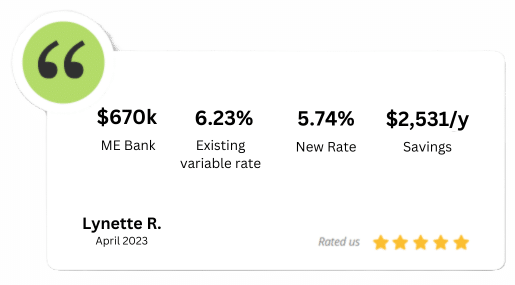

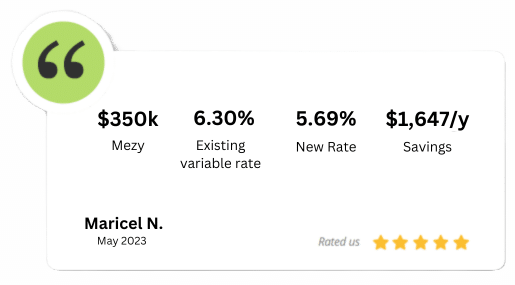

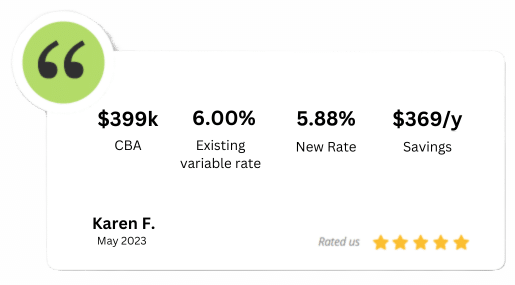

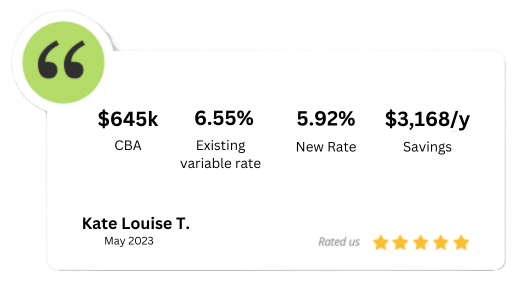

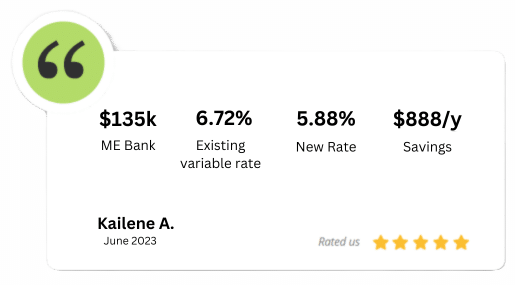

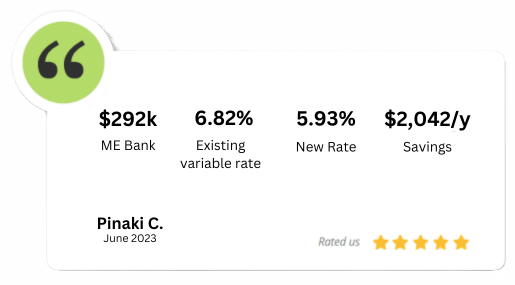

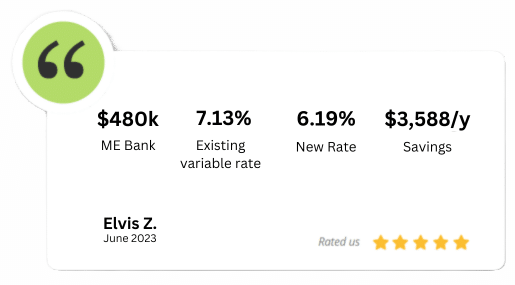

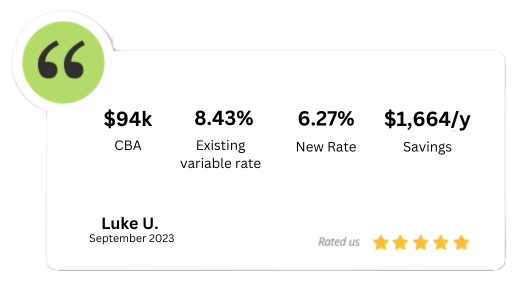

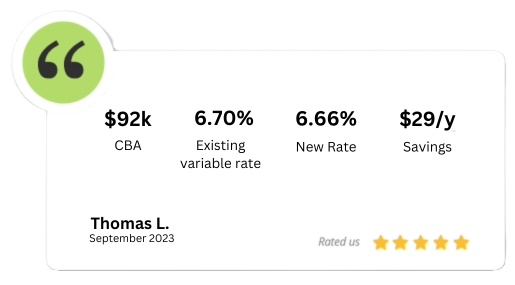

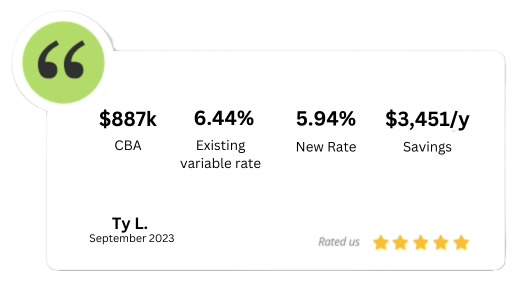

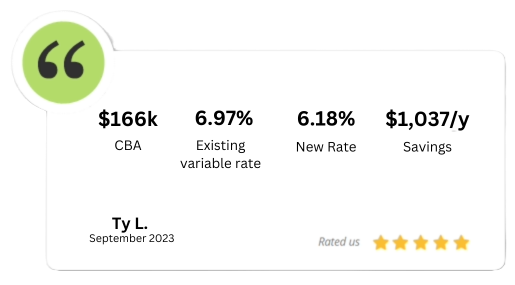

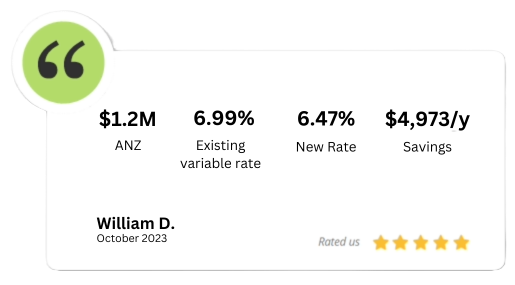

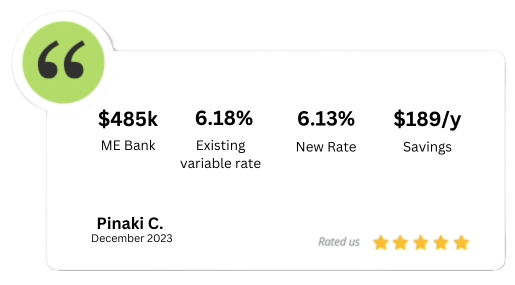

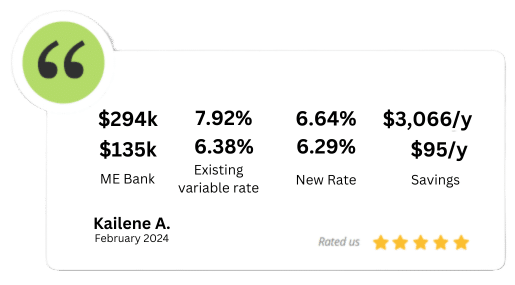

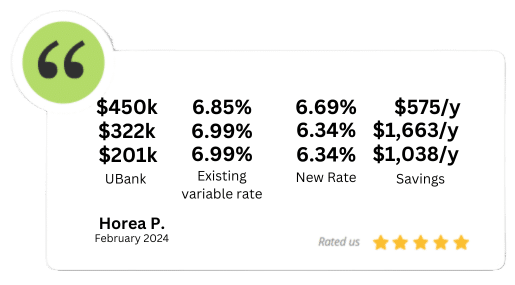

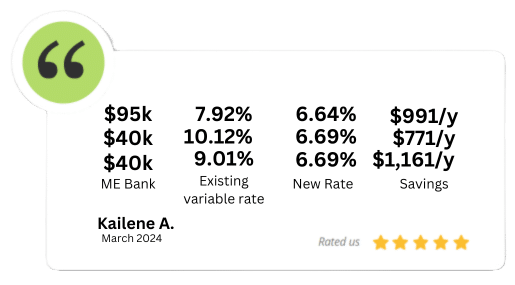

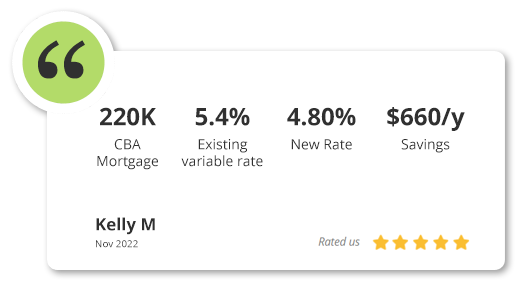

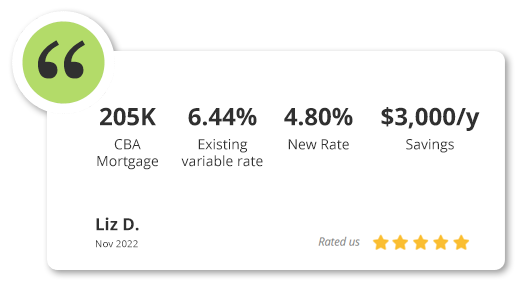

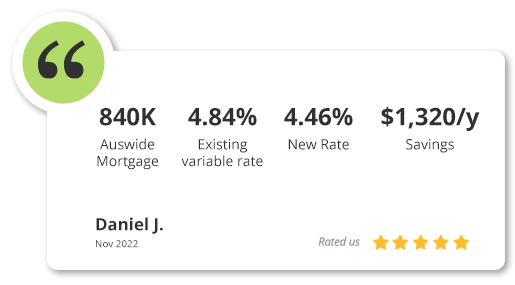

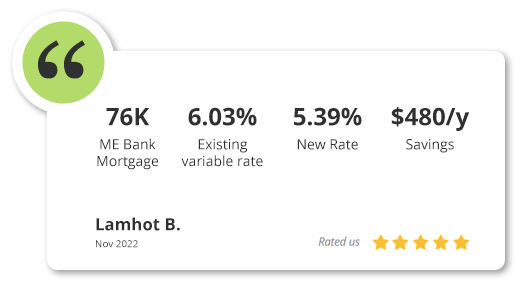

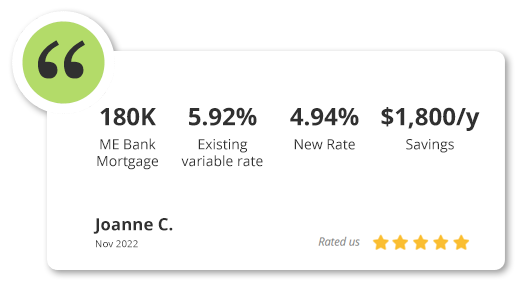

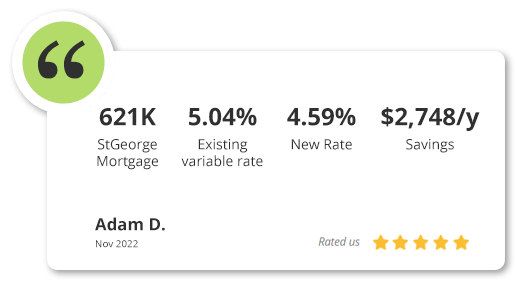

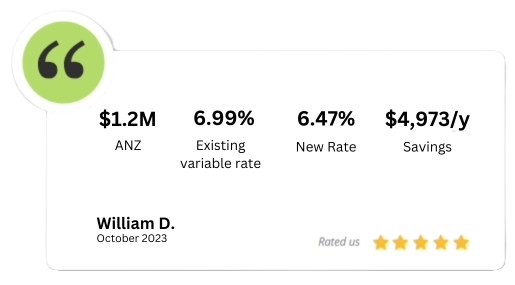

Savings achieved for customers

What are you waiting for?

Still not sure? That’s ok. Being skeptical (or too busy) is normal. For the skeptics, read here an independent report on “loyalty tax”. A common practice where banks charge more to existing customers. Or maybe this is just not important enough for you. We understand.

But if you are still reading….. Consider this. Even a $100 a month saving is $1,200 a year (or $30,000 over 25 years!). That would pay for a nice long weekend away. Money in your pocket instead of the bank.

It could also go to your super or towards college tuition for your kids…. For us the bottom line is this: Why would you pay more than someone else for exactly the same product? Why should your loyalty cost you whilst a new customer gets a better deal?