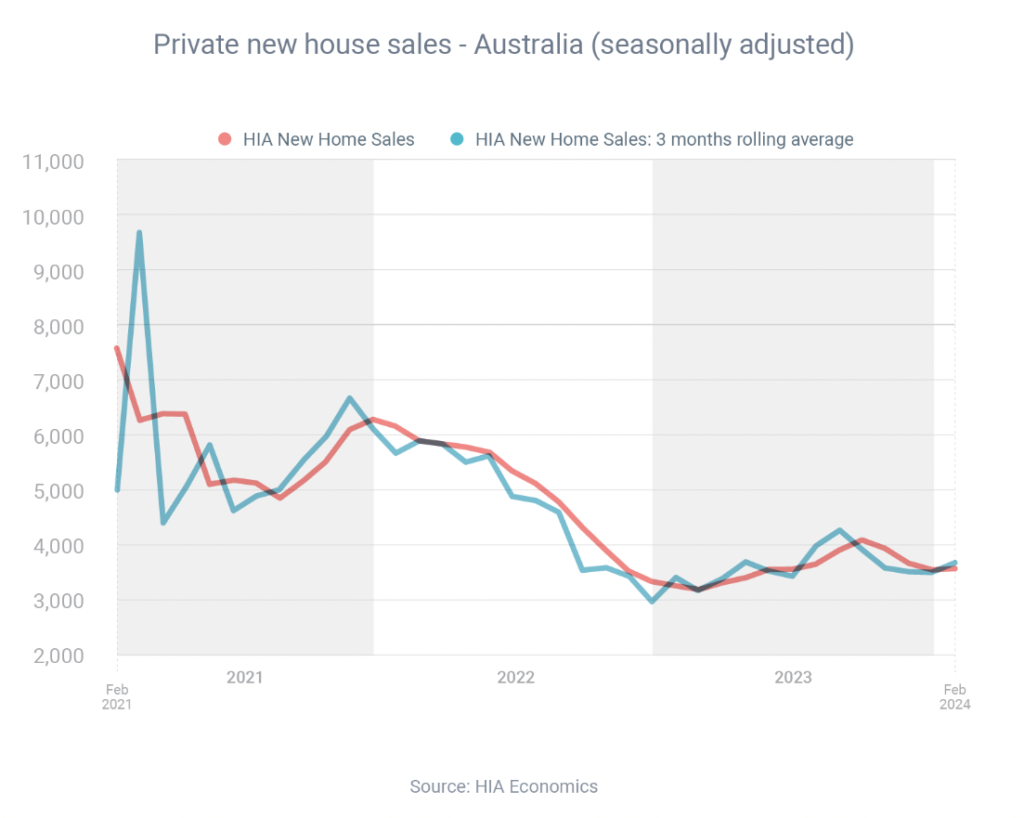

Australians purchased 5.3% more new homes in February than the month before, according to the Housing Industry Association (HIA).

However, HIA chief economist Tim Reardon said this increase was off a “very low” base. Based on the number of new homes being approved for construction and purchased, he forecast there would be a decade-low amount of homebuilding activity in 2024, despite the pent-up demand for housing.

Nevertheless, banks are still keen to lend to Australians who want to build a new home or renovate an existing one. To finance your project, you’ll need a construction loan (rather than a regular home loan). Here’s how construction loans work:

-

To apply for a loan, you need to provide the lender with your building contract, building plans and council approvals

-

You receive the money in stages (usually five) throughout the project, rather than one lump sum at the start

-

You pay interest only on the portion of the loan you’ve received, not the entire amount

-

Construction loans typically have terms of 12-24 months; they may then revert to a standard home loan

Do you need a construction loan? We got the best deal for you. Schedule a call with us to learn more.

Leave A Comment