What is Comprehensive Credit Reporting or CCR? And why does it matter?

Comprehensive Credit Reporting (CCR) is also known as positive reporting. Simply put, if you make repayments on time each month, this good credit behavior will be recorded on your credit report. This is a change from previous reporting where only serious defaults (payments more than 90 or 120 days late) were listed. So now your credit rating can change –for better or for worse- as a result of your payment behavior.

This additional information collected by credit bureaus can -and will- be used by credit providers when making a lending decision. It impacts you as this is used by banks to raise interest rates on your home or investment loan(s). Lenders having more information about your credit history could also lead to more fluctuations in the interest and fees they charge.

What are they tracking? It’s your home loan, credit card, personal loan, car loans, power bill and your phone bills.

Can I stop my information from being shared? Nope. By law, the big four banks must share their CCR data. It is optional for smaller banks and some lenders, but most are reporting the information.

How to stay on the good side of CCR?

- Be careful about constantly switching credit card providers. If you have one hidden somewhere that you are not using, you might as well cancel and close it.

- Notify your credit providers of address changes quickly when you move.

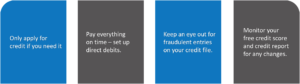

- Research thoroughly before applying for credit (specifically the lenders policies) and only apply when you really need it.

- Under CCR you have a 15-day grace period before a missed payment goes on your record.

- Pay your bills on time – always, no exceptions. Direct debit is a great option to remove the chore of remembering.

- Your credit file is an incredibly important and valuable asset. Be mindful of how much information you provide to online sites; identity is a growing trend.

- Regularly check your details

Leave A Comment