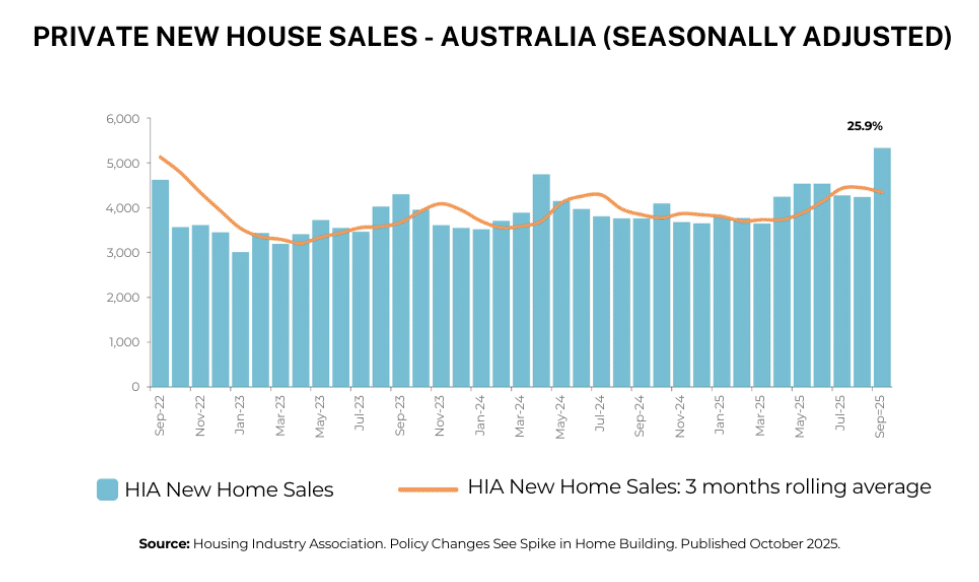

With established property prices climbing, more Australians are finding better value in building. This is reflected in new data from the Housing Industry Association (HIA), which shows new home sales rose 25.9% in September and 4.0% over the quarter.

HIA chief economist Tim Reardon said lower interest rates, government incentives and rising property prices have made building comparatively more affordable. In many areas, construction now stacks up better than buying an existing home.

Financing a build comes with different challenges – progress payments, loan approvals and cost variations all need careful planning. While building can offer long-term value and access to incentives, managing cash flow and unexpected costs can be tricky.

Five tips for financing a new home build

-

Set a clear budget – include a 10–15% buffer for unexpected costs.

-

Secure pre-approval early – it defines your borrowing power and helps you plan your build with confidence.

-

Understand your loan – funds are released in stages, so know when payments occur.

-

Plan for cash flow – you may have to pay rent or a mortgage while building.

-

Stay in touch – advise your lender quickly if costs or plans change.

Thinking about building? Let’s chat about your finance options before you start comparing floor plans.

Leave A Comment