TAX DEPRECIATION

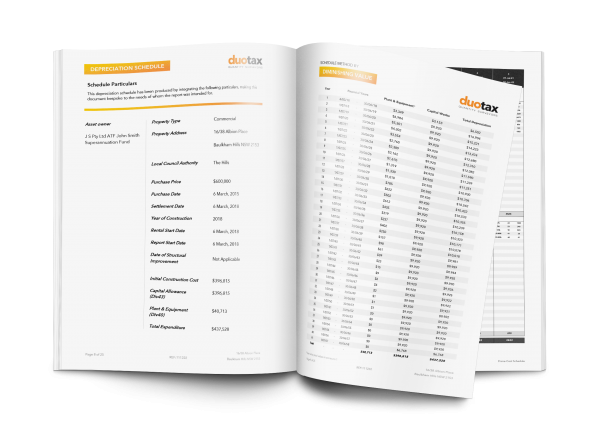

A tax depreciation schedule is an Australian Taxation Office (ATO) complying document that helps property investors unlock the tax deductions available to them. A schedule captures the wear and tear of a building over time. The ATO classifies this wear and tear as an expense to investors which they are entitled to claim as a tax deduction.

QUANTITY SURVEYOR

A tax quantity surveyor is called upon to determine the wear and tear of these items and provide the tax depreciation schedule. Duo Tax Quantity Surveyors are Registered Tax Agents to provide the ATO complying document.

Unsure? Feel free to speak to our friendly staff at any of our office locations and they are willing to help.

DEPRECIATION EXPLAINED

IN WHAT SCENARIO ARE YOU ELIGBLE TO CLAIM DEPRECIATION?

- Brand new residential properties

- Buildings that still qualify for building depreciation (division 43)

- Second-hand properties that have had substantial renovations

- Second-hand properties that have had minor renovations

- Investors that purchase property in Managed Funds

- Corporate entities that buy properties (e.g. Pty Ltd Company)

- Second-hand properties owners who purchase new plant and equipment

- Owners who switch from Principal Place of Residence (PPOR) to rental properties prior to 1st July 2017