Your Trusted Mortgage Broker in Carlingford

Local, experienced and ready to help you buy, refinance or invest in Carlingford

Your Trusted Mortgage Broker in Carlingford

Local, experienced and ready to help you buy, refinance or invest in Carlingford

Why Locals Trust Erik Reurts & Micah Finance

- Erik is a 90+ 5-star rated broker in Sydney’s North-West

- Deep understanding of the local property market

- First home buyer and investment property experts

- Personalised advice with bank and non-bank lenders

- Seamless, time-saving loan process

Real Results for Clients

Case Study – How We Helped an investment Buyer in Carlingford….

“Suzie and Jack had their home in Carlingford already and the mortgage was well under control. The kids had flown the nest and money was easy. Time to look at a better retirement plan. For Suzie and Jack, this meant property investing. They had owned their home for more than 20 years and had seen what time can do to property values. They wanted more of that!

They wished they would have started many years ago but then they told me a great story: “the best time to plant a tree is 20 years ago. The second best time is now.” This means we are ready to start.

We started with the basics:

- What is the plan? (Is it accumulation of “x” number of properties or $..m in net wealth or $… in free cashflow each month?)

- What is the timeframe? (Do you have 20 years to achieve this, are you aiming to retire early?, …)

- What is your starting point? (what assets are available already? Own residence, investment properties, cash, super annuation, SMSF, shares, Business, …)

Then the boring stuff (but we did that so we could prevent Suzie and Jack from falling asleep….)

- Borrowing capacity. Living expenses, income and current mortgage commitments

- Lender policy

- Loan and wealth structuring

The outcome of that meant they could easily afford a $1.5m investment. Great start! They opted for a residential investment comfortable within their borrowing capacity so that they would be able to look at a next property within 12 months. The aim for this property was capital growth to build their asset base stronger.

We then put them in contact with a quality property research group to make sure they were getting a property that would meet (and hopefully exceed) the planned growth. We talked to them about the importance of buying a quality property and getting professional guidance with that as not every property will “just go up in value”. Even in Sydney you can get it wrong….

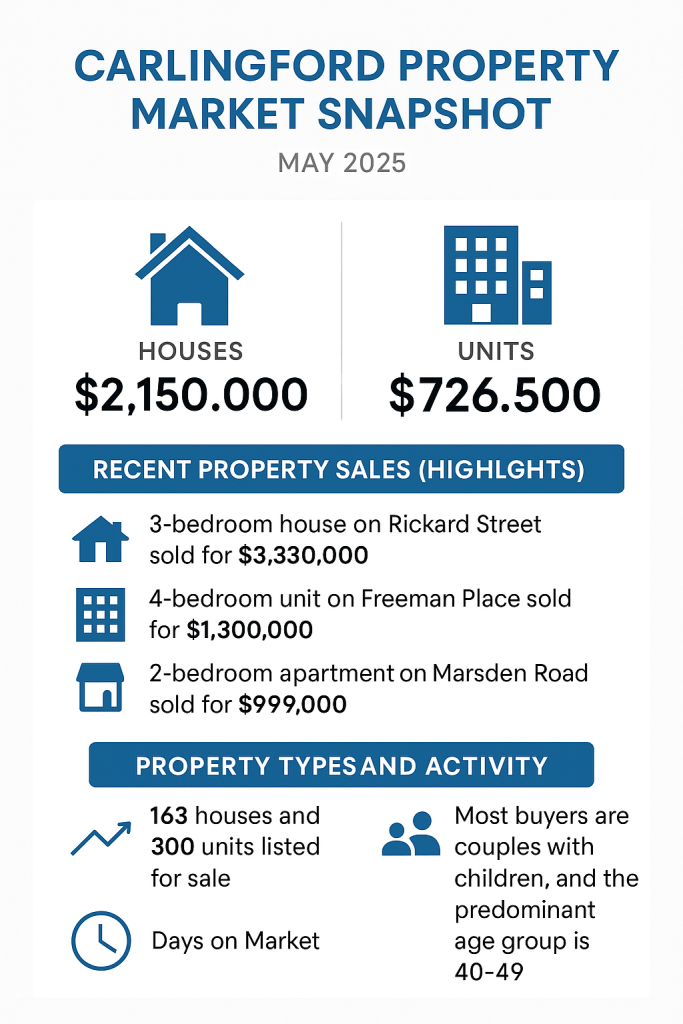

🏡 Carlingford Property Market Snapshot – May 2025

Carlingford continues to be a sought-after suburb in Sydney’s north-west, attracting families, professionals, and investors alike. With strong transport links, quality schools, and a mix of established homes and modern apartments, it’s no surprise demand remains steady.

💰 Median Property Prices

-

Houses: $2,150,000

-

Units: $726,500

Whether you’re upsizing or buying your first home, Carlingford offers a range of price points to suit different buyers.

📈 Recent Property Sales (Highlights)

-

A 3-bedroom house on Rickard Street sold for $3,330,000

-

A 4-bedroom unit on Freeman Place sold for $1,300,000

-

A 2-bedroom apartment on Marsden Road sold for $999,000

Properties in Carlingford range from budget-friendly apartments to premium family homes, giving buyers a variety of options depending on their goals.

🏘️ Property Types and Activity

-

There are currently 163 houses and 300 units listed for sale.

-

Most buyers are couples with children, and the predominant age group is 40–49.

-

Average ownership tenure is around 13 years, showing that people love staying in the area.

⏱️ Days on Market

Properties are selling relatively quickly, especially those priced well and presented to today’s buyer expectations. High demand paired with limited supply means buyers need to be ready to act fast.

First Home Buyer Help in Carlingford

Need Help With a Home Loan in Carlingford?

- We are a First home buyer specialist

- Access to all government programs like First Home Buyers Guarantee scheme, Stamp Duty exemption, FHB Grant and more

- LMI waivers, <5% options

- Bank and non bank lenders

- Fast. We typically arrange a pre approval in a few days

- Support. We have a 6 step program to help you identify & secure the prefect property for you

- Fall outside the First Home Benefits? Access our 85% NO LMI lenders OR ask us about the 100% loan option

As a mortgage broker in Carlingford with over 20 years experience, I provide personalised home loan help for home loans (owner occupied) and investment finance.

🧭 Interesting Facts About Carlingford

📍 Location: Just 18km northwest of the Sydney CBD

🌳 Green spaces: Over 12.8% of the suburb is parkland—perfect for families

🎓 Top Schools: Carlingford High School, James Ruse Agricultural High, and Murray Farm Public are top draws

🚊 Transport: Access via Carlingford light rail (coming soon), M2 motorway, and local buses

🏡 Home to families: The dominant demographic is families with school-aged children aged 40–49

🏘️ Property ownership: Average ownership period is 13 years, showing a strong sense of community and long-term appeal