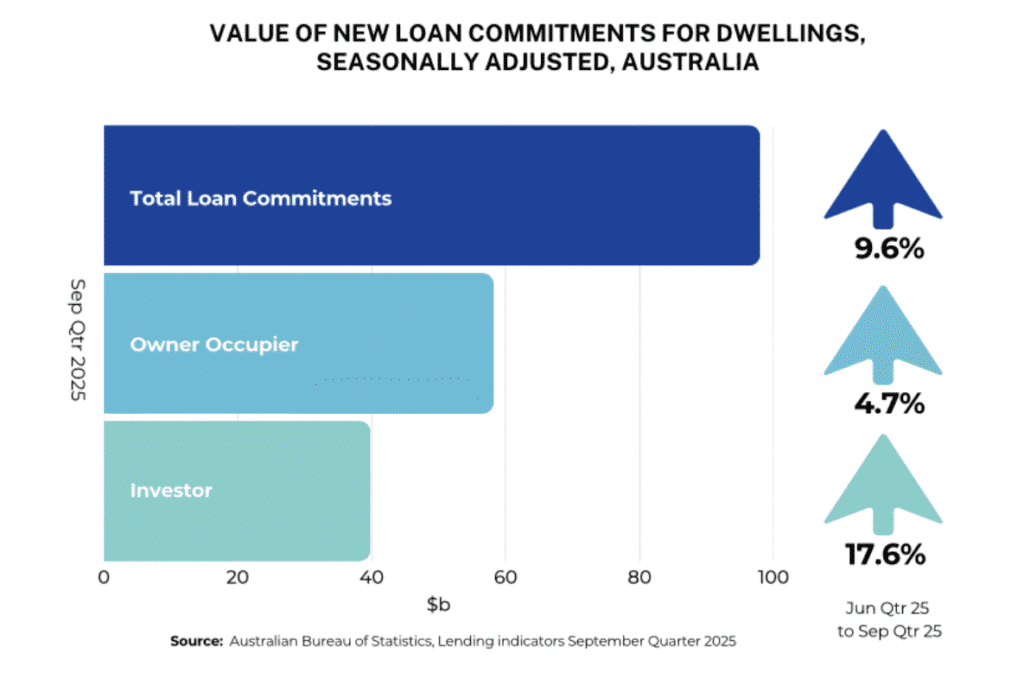

More investors are stepping back into the market – and the data shows it’s a big shift.

The latest figures from the Australian Bureau of Statistics show the value of investor loan commitments jumped 17.6% in the September 2025 quarter, and was 18.7% higher than a year earlier.

Investors now account for 40.6% of the value of all new loan commitments, the highest share since 2016. That tells us investor confidence is building, even as affordability pressures remain.

What’s pulling investors back in?

Price growth and rental demand are doing the heavy lifting.

-

National dwelling prices rose 8.6% over 2025.

-

Rents climbed 5.2% over the same period, supporting stronger rental income.

Yields did edge lower, slipping from 3.7% at the end of 2024 to 3.6% at the end of 2025, because prices rose faster than rents. Even so, yields remain well above the pandemic low of 3.2% in 2021.

For investors, yield is only one part of the equation. Borrowing capacity, cash flow buffers and loan structure also matter, because they determine how sustainable an investment is, not how profitable it looks on paper.

If you’re thinking about investing, I can help you sense-check the numbers and see how an investment loan would stack up alongside your existing commitments.

Leave A Comment